AFR's Banking Crisis of '23 Brief: 23rd Edition

A cogent email of curated information on the banking crisis and the response

Megabanks Scheme to Undermine New Capital Rules

What distinguishes JPMorgan Chase the largest bank in the United States – $2.7 trillion in assets – from its competitors? “We've got our smartest people figuring out every angle to reduce capital requirements for JPMorgan,” CEO Jamie Dimon says. “That’s the difference.”

Instead of having his talented employees figuring out how to better serve customers or allocate credit to the real economy, Jamie Dimon has his best and brightest scheming how to evade tougher rules on bank capital that regulators are writing to make the financial system safer. One of their key tactics: imitate the shadow banks whose lack of regulation they decry.

Read about the Wall Street megabank plans on capital rules here.

FINANCIAL STABILITY: Regulators – Fed Ethics – Executive Excuses – The Great Rate Debate – Rise of the Finance AI – Fed Boards and Bankers – Deposit Insurance – Asset Manager Risks

CONSUMER: CFPB and SCOTUS

PRIVATE EQUITY: Profiting on Banking Turmoil – And On National Security – Consolidation – German Soccer Fans

CRYPTO: Stablecoins – Crypto as Gambling?

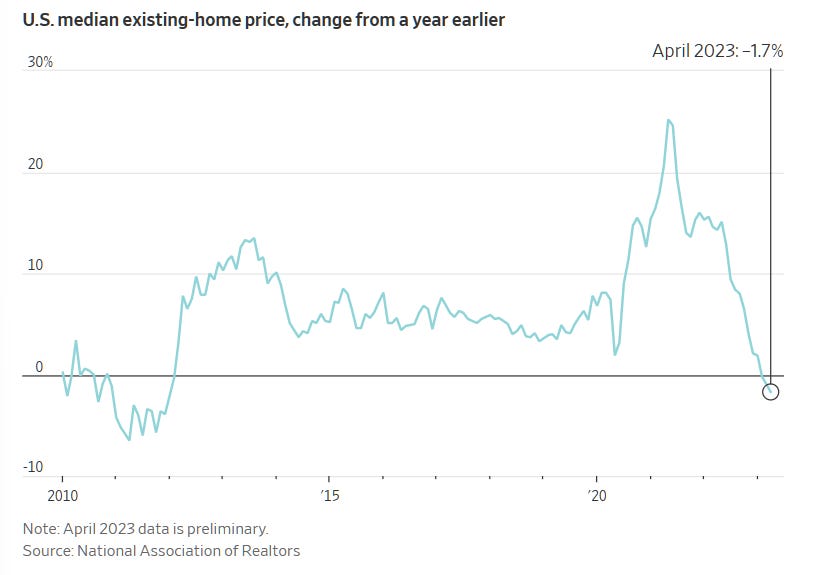

HOUSING: Home Prices

POLITICS and MONEY: DeSantis, Again

Feedback? Reach us at afrbrief@ourfinancialsecurity.org

FINANCIAL STABILITY

Regulators.

Senate Banking held a hearing on Thursday probing regulators. Hsu made it a point to mention that none of the failed banks fell under the OCC’s oversight, but Warren pressed him to explain how the OCC’s approval of too-big-to-fail JPMorgan’s buyup of First Republic would not affect financial stability. Per Warren, reports NYT’s Emily Flitter:

“Your job by law is to determine risk to the system from making big banks even bigger and you have a clear metric for doing that--the GSIB score...Did you just ignore the fact that a failure of JPMorgan would blow a hole in our financial system?"

The Warren-Hsu exchange video is wonky but spicy.

Related: Jamie Dimon called it “unlikely” that his bank would make any further acquisitions after its takeup of First Republic.

Fed Ethics.

Warren penned a letter to Inspector General Bialek criticizing his Office for failing to hold Fed officials, including Powell, accountable for unethical trading activity. She cited the Fed OIG’s April 2023 evaluation of rules put in place after a 2021 report revealed high-level officials were making securities trades relevant to Fed actions to mend the pandemic-stricken economy. Warren’s letter comes before the senator holds a hearing to investigate the trading scandals and bolster the regulator’s accountability.

…gaps in the review and your uncritical acceptance of explanations for clearly improper behavior render the findings of the Inspector General’s (IG) report simply not credible… Your failure to hold Chair Powell – at whose discretion you serve – accountable is the clearest possible example showing that your office lacks the tools necessary to effectively perform its important responsibilities as the Fed’s independent watchdog.

During the hearing, Warren blasted Bialek’s evaluation as a “sham investigation” and members of both parties accused him of greed and insufficient oversight.

Sens. Warren and Scott have introduced a bill which would make the Fed IG a president-appointed, Senate-confirmed role. Currently, the position is appointed by the Fed chair. Bialek has written in opposition to the proposed legislation.

Executive Excuses.

Senate Banking also heard from SVB’s Becker and Signature’s Shay and Howell at a Tuesday hearing, and House Financial heard from Becker and Shay, among others, at a Wednesday hearing.

Politico sums up the major takeaways from Tuesday’s hearing. The bank execs were quick to claim that they had done all they could in light of “unprecedented events.” Sen. Brown dug into Becker for a lack of accountability:

"Mr. Becker, your version of events blames SVB's failure on too many interest-rate hikes, a social media-driven bank run, the closure of the much smaller Silvergate Bank and the regulators for being slow to highlight its longstanding problems. It sounds a lot like the dog ate my homework."

Among senators, there was bipartisan agreement that greater accountability was needed, including changing incentives on executive compensation. At Tuesday’s House Financial hearing, Velazquez grilled regulators on the topic of executive compensation, following up on a letter previously sent with Van Hollen. The agencies say they’ve been meeting regularly and are committed to laying down a rule. Reminder: AFR supports clawbacks and further action on compensation.

Also: Signature execs were apparently musical aficionados, belting out lyrics about profitability in a music video (now removed) not long before the bank’s fall.

The Great Rate Debate.

A panel of top Fed officials debated the direction of interest rates this week with no consensus and the next potential move coming in mid-June. Some expressed an inclination toward holding rates steady. Cleveland Fed president Mester was interested in another hike, with Dallas Fed president Logan concurring on Thursday. NY Fed’s Williams gave no clear indication, but was willing to watch how current conditions pan out. WSJ reports the decision is “shaping up as a close call.”

Rise of the Finance AI.

Gensler looks forward warily to a potential source of systemic risk: financial institutions’ use of AI. He imagines a future where hypothetical observers might remark that “the crisis in 2027 was because everything was relying on one base level, what’s called [the] generative AI level, and a bunch of fintech apps are built on top of it.” JP Morgan has already set an AI to work interpreting Fedspeak.

Fed Boards and Bankers.

NYT explores how an arrangement older than a century gave way to SVB’s Becker sitting on the SanFran Fed board. Since 1913, regional reserve bank boards have been partly host to bankers, and these boards may occasionally grant their members benefits – “either an actual or a perceived information advantage about the economy and about monetary policy.” These days, however, some suggest the boards have very little actual power, rather just acting “like a glorified advisory committee,” per UPenn professor Kaleb Nygaard.

And: an NY Fed board member stepped down a day after his resignation from a bank holding company flagged by Nasdaq as noncompliant.

Deposit Insurance.

After the FDIC’s special assessment, some banks are trying to convince regulators and lawmakers to allow them to pay in Treasurys instead of cash. The idea: let the banks give the FDIC their devalued securities at full, rather than market, price. In a related matter – warning: this is a joke – consumers are lobbying to let people pay off credit card bills in worn-out shoes, half-filled paint cans, and broken vacuum cleaners – valued at their original price, of course.

Columbia prof. Todd Baker dissects the FDIC’s deposit insurance system with an eye toward its history. “Shareholder value maximisation” theory ramped up among banks and incentivized risk-taking as shareholders grew more active and equity awards to managers became entwined with stock price. It’s a far cry from the conservative practices the system was designed for, according to his analysis. Baker suggests incentive changes rather than a simple limit change.

Asset Manager Risks.

The Bank for International Settlements, the international organization of central banks, recently published a revision to a March 2021 paper zeroing in on risk-taking and bank regulation and the behavior of asset managers:

“When asset managers count on the central bank to back[s]top liquidity by absorbing fire sales, they take excessive risk… We find that because the potential for a liquidity backstop makes AMs’ risk-taking excessive from a social perspective, the disciplining effect of the regulatory constraint improves welfare.”

CONSUMER

CFPB and SCOTUS.

Over 140 current and former Democrats filed an amicus brief with SCOTUS in defense of the Consumer Financial Protection Bureau against attempts to subject it to annual congressional appropriations. Their brief follows a separate brief from AFR and nine other organizations earlier this month. Dems on Senate Banking tweet:

Republicans and Wall Street have always hated the CFPB because it stands up to them and fights for consumers. Their latest attack threatens the CFPB AND other agencies like the Fed and FDIC that keep our economy stable.

PRIVATE EQUITY

Profiting on Banking Turmoil.

A Bloomberg retrospective explains how private equity firms like Blackstone, Apollo, and KKR,, after the 2008 crisis, “were quick to occupy gaps in lending markets vacated by banks.” Shadow banks like private equity saw a jump in market share of leveraged loans from 54% in 2000 to 75% in 2022; private credit also showed an increase.

And on National Security.

Some private fund managers are increasingly banking on geopolitical stress for profit. According to Bloomberg, Cerberus Capital Management is raising a $2.5bn fund to bankroll U.S. supply chain businesses in expectation of a “global resurgence of great power competition that will drive geopolitical tensions.” Cerberus has ties to major players in national security – e.g. Depts. of State, Energy, Homeland Security – and national intelligence.

Consolidation.

Private equity firms are becoming larger and more consolidated as more firms eye their market peers for takeovers. From 2020 to 2021, the number of acquisitions from the world’s 50 largest asset managers doubled to its highest in a decade, 25. Last year saw 18 such transactions.

German Soccer Fans.

…are not fans of private equity, which is courting their football league. A survey indicates that nearly 70% of fans are opposed to outside investment. That may stop private investors, since any deal requires the backing of two-thirds of the teams in the Bundesliga.

CRYPTO

Stablecoins.

The House Digital Assets subcommittee held a Thursday hearing hashing out how the U.S. should allow stablecoins to proceed as a form of payment. AFR issued a statement ahead of the hearing expressing concern that the draft proposals fall short of what is needed to address the risks posed by stablecoins:

If the Committee decides to move forward with legislation, it must adequately and

comprehensively address the risks associated with stablecoins, many of which are similar to the risks posed by banks; including, but not limited to: run risk, credit risk, operational risks, and liquidity risk, as discussed in the President’s Working Group report on stablecoins.

Per Politico, Yale researcher Steven Kelly takes issue with lawmakers’ approach, suggesting that both McHenry’s and Water’s bills would fail to prevent the coins from contributing to financial instability during times of stress. See here:

To provide crypto services to their customers, nonbank stablecoins are effectively gathering insured deposits and transforming them into uninsured deposits and other wholesale funding—funding which has a fiduciary obligation to run at the first sign of trouble. If stablecoins really are to be “payment stablecoins” as Congress is wont to call them, they should be just that: a payment technology—and one that exists underneath the banking system’s deposit ledger.

Crypto as Gambling?

The UK Parliament’s Treasury Committee puts a novel prospect on the table: regulate consumer trading in unbacked crypto as gambling. Their report finds that “the price volatility of unbacked cryptoassets exposes consumers to significant risks of losses” and tangible environmental risks, among others. Reads the report:

“Unbacked cryptoassets have no intrinsic value, and their price volatility exposes consumers to the potential for substantial gains or losses, while serving no useful social purpose. These characteristics more closely resemble gambling than a financial service, an impression reinforced by the evidence we have received of consumer behaviour.”

HOUSING

Home Prices.

WSJ reports they experienced the largest annual decrease in more than 11 years, the median existing-home price dipping 1.7% from April 2022 to April 2023 and home sales dropping 23.2% in the same period.

POLITICS and MONEY

DeSantis, Again.

The Lever reports on how the Florida governor moved pension investments to high-fee, high-risk and underperforming firms whose affiliates have plumped DeSantis’ coffers with donations. Take the private equity firm Thoma Bravo as an example, which received $150mn in from Florida pensions after one of TB’s cofounders contributed to the DeSantis-friendly Republican Governors Association. Only days earlier, the RGA donated $2mn to the governor.