Financial Justice: Binance, “A fking unlicensed securities exchange.”

The SEC has sued Binance for mishandling customer funds, inflating trading volumes and lying to regulators and investors. NYT reports the agency accused the crypto exchange of mixing billions of dollars of customer cash and sending it to a separate company controlled by Binance’s founder, Changpeng Zhao.

That headline comes right from the SEC charging document, and it reflects the often-cavalier attitude that crypto folks take toward complying with the law. Go to paragraph 111:

As Binance’s CCO bluntly admitted to another Binance compliance officer in December 2018, “we are operating as a fking unlicensed securities exchange in the USA bro.” (Emphasis added.)

However, crypto money – the real stuff, U.S. dollars – speaks loudly on Capitol Hill, where House Financial’s McHenry and House Agriculture’s G.T. Thompson unveiled a draft bill that would reset the jurisdictional divide between the SEC and CFTC. It would disempower the SEC, the regulator that is enforcing the law right now. SEC chair Gensler has previously made his stance clear: exchanges should register and comply with the rules. Binance did not.

Under the draft bill, tokens could be certified on the basis of decentralization, leaving the SEC’s oversight and entering the CFTC’s domain, effectively treating it as a commodity instead of a security. Additionally, the legislation would keep the SEC from barring trading platforms from operating as alternative trading systems if it trades digital assets. And it would exempt sales of digital assets from securities laws if they meet certain conditions, including a $75mn annual sales cap.

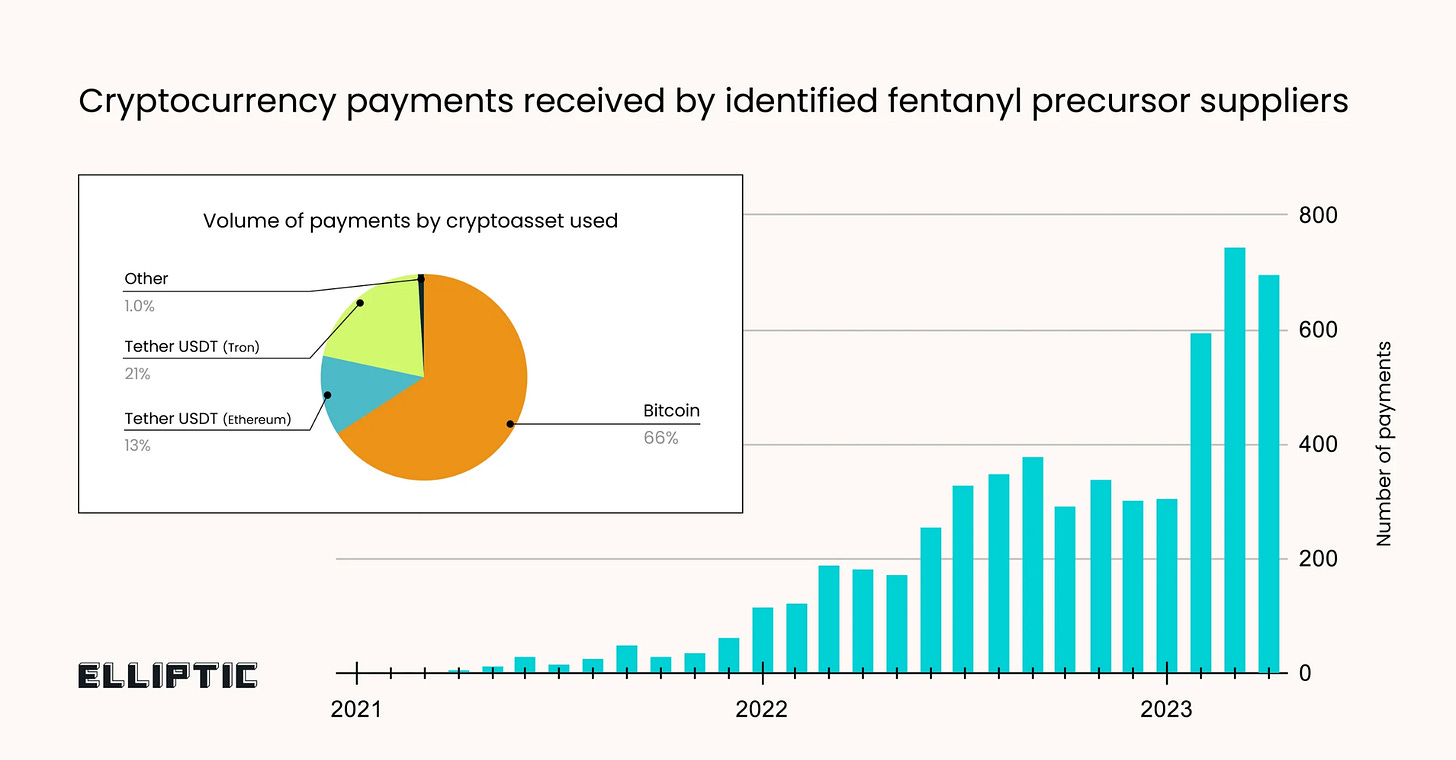

Drugs and (Digital) Money. Warren has made calls for greater regulation after research revealed that crypto payments to China fuel the American fentanyl crisis, per a report from Elliptic Research. About 90% of more than 90 China-headquartered companies that supply “fentanyl precursors” accept crypto. These companies’ wallets have seen over $27mn – enough to manufacture $54bn of fentanyl pills – across a transaction volume that has increased 450% year-on-year. Some companies investigated by Elliptic offered actual fentanyl.

FINANCIAL STABILITY: The Fed – Commercial Real Estate – Crisis Case Studies – A Backstop for Homebuyers

CONSUMER: Payment App Deposit Insurance – Student Loan Servicers – Fintech and Properties – Fintech Lending – OneMain Penalty – Apple Withdrawals – CFPB and PayPal

CAPITAL MARKETS: SPAC for Insiders

PRIVATE MARKETS: Preying on Hospices – PE and Life Insurance – PE and Healthcare – PE and CRE – Private Credit Boom

CRYPTO: Hong Kong Crypto

HOUSING: Fighting for Rent Control – Zombie Mortgages

CLIMATE AND FINANCE: Republicans and ESG

Feedback? Reach us at afrnews@ourfinancialsecurity.org

FINANCIAL STABILITY

The Fed.

The Fed’s H.4.1 report released Thursday illustrates that its lending to banks by way of the Bank Term Funding Program was largely stable in May but climbed to its highest level for the month in the week ended Wednesday, as WSJ’s Nick Timiraos presents.

Commercial Real Estate.

In the next two years, $1.5tn in commercial real estate mortgages is coming due. High interest rates and vacancies are killing property values. Smaller lenders and regionals hold 70% of bank-held commercial mortgages. Politico calls it a “slow-motion trainwreck,” and lawmakers are concerned. Sen. Warren calls for regulators to “insist that banks and other lenders appropriately hedge against the risks of a significant downturn in commercial real estate.” Says Sen. Warner:

“Right now, we have the double whammy of much higher interest rates and the commercial real estate market going through a shock post-Covid… So I don’t think we can presume that... we’re going to be able to simply glide through [without a crash]... I have encouraged the White House, though, that we need to do some more intervention on these regional banks right away.”

Crisis Case Studies.

Financial Stability Board chair Knot, also a central banker himself, recommends a review of the liquidity coverage ratio calculation and the application of bank rules in the wake of the sector’s crisis. As well, Knot urges regulators to reconsider what banks fall under Basel III capital standards due to their systemic importance.

A Backstop for Homebuyers.

…went instead to the banks, reports Bloomberg. The Federal Home Loan Banks (FHLBs) system, a Great Depression-era initiative to put cash in the hands of lenders to homebuyers, has in recent years served to prop up private financial institutions. SVB, Signature and First Republic had between them $54bn from FHLB by the end of 2022. Even the largest banks dip in; Wells Fargo, JPMorgan and Citigroup held a collective $62bn in FHLB financing.

“What the home loan banks have become is a source of general liquidity to big banks,” said Bruce Morrison, former chair of the Federal Housing Finance Board. “They’ve made a great contribution for the last 50 years, but the market has changed. They’re doing a job that the Fed should be doing.”

FHLBs notably don’t track how banks put their financing to use. At the moment, there’s an effort in Congress to require them to put 20% of their profits toward housing affordability.

CONSUMER

Payment App Deposit Insurance.

A Consumer Financial Protection Bureau analysis finds the billions of dollars that flow through or sit in payment apps such as PayPal, Venmo and CashApp may not be protected by deposit insurance. More than 75% of U.S. adults have used a payment app; that figure jumps to around 85% among 18 to 29 year olds. And last year, providers saw $893bn in transaction volume, expected to rise to approximately $1.6tn by 2027. In time with the report, the CFPB issued a consumer advisory warning users about the risks of keeping uninsured sums in these services.

Student Loan Servicers.

The Student Borrower Protection Center scrutinizes the incoming class of five companies vested with the responsibility to service nearly $1.6tn in federal student loans for 43 million borrowers via the Dept. of Education’s Unified Servicing and Data Solutions program. The previous servicers, writes SBPC, misled borrowers about their relief or forgiveness eligibility, pushed them into forbearance when they qualified for income-driven repayment, subjected them to improper debt collection and more. The new servicers aren’t much different.

Fintech and Properties.

The CFPB joined the Federal Housing Finance Agency and four other regulators to propose a rule which would regulate fintech programs used by banks and mortgage issuers to value residences. Called automated valuation models (AVMs), these programs can make the appraisal process speedier and bring down lending costs for consumers, but the cadre of agencies wants to ensure that they’re accurate, can defend against data manipulation, avoid conflicts of interest and adhere to nondiscrimination laws.

Related: Vice President Harris has plans to head up an initiative to tackle racial bias in home appraisals.

Fintech Lending.

Colorado’s legislature is moving to ban interest rate “imports” by opting out of a provision in the federal government’s DIDMCA legislation, reports WSJ. In these schemes, fintech lenders can circumvent a state’s interest rate cap by partnering with banks in other states to “import” those outside rates. It’s a move popular by consumer advocates, but fintech lenders are afraid that other states will follow suit to rein them in.

OneMain Penalty.

The CFPB ordered Indiana-based OneMain Financial to pay $20mn in fines and refunds for its part in “unfair, deceptive and abusive acts” by pushing employees to saddle loan customers with “add-on” products marketed as coming with full refunds. According to the CFPB, OneMain retained $10mn in interest that should have been refunded.

Apple Withdrawals.

In April, Apple launched a new savings account offering in partnership with Goldman Sachs, garnering nearly $1bn in deposits in its first four days. Now, some consumers say they’ve been having trouble transferring their money out according to WSJ. Between reports of weeks-long delays and contradictory instructions from service reps, some customer dollars have been unexpectedly tied up.

CFPB and PayPal.

Both have refiled legal claims in a battle over disclosure requirements for digital wallets in the CFPB’s prepaid card rule, reports American Banker. In February, a federal appellate court sided with the bureau, finding the rule “did not mandate specific fee disclosures for digital wallets” in line with the Electronic Fund Transfer Act. Other claims were kicked back down to the district court. The suit, filed by PayPal in 2019, is expected to ramp back up with a decision expected either by the end of the year or early next year.

CAPITAL MARKETS

SPAC for Insiders.

When the special-purpose acquisition company (SPAC) boom went bust, leaving investors out billions, insiders at the companies came out with $22bn in trades. Reporting from WSJ found among the more than 460 that inked SPAC deals, 232 exhibited insider selling in SEC filings through May 18. Twelve racked up cumulative sales worth at least $500mn, while 80% hit less than $100mn. Insiders reportedly sold an average of $22mn each.

Now, investor lawsuits are bringing the billionaire “SPAC Kings” to court, reports Bloomberg. Many of the suits claim that executives pushed acquisitions to market even if over-optimistic valuations and business plans posed a long-term threat to other shareholders. More than 100 companies dropped 90%.

PRIVATE MARKETS

Preying on Hospices.

A new report from the Center for Economic and Policy Research details how private equity has profited off for-profit hospice care by exploiting loopholes in Centers for Medicare & Medicaid Services (CMS) payment models. The CMS’ hospice benefit pays a fixed amount to the hospice agency for every day that an eligible Medicare recipient within six months of death is enrolled in their program. For-profit agencies, increasingly owned by private equity, unscrupulously use this to their advantage by taking on dementia patients, whose life expectancies are more difficult to pin down. Comparatively, nonprofit providers have a greater proportion of cancer patients whose terms tend to be shorter and require more intensive care.

On top of this tactic, for-profit agencies have also exhibited higher rates of patient neglect and denial of care. In some cases, they may even commit Medicare fraud by accepting ineligible, non-terminally ill patients and providing limited services.

PE and Life Insurance.

Leader’s Edge dissects private equity’s expanding role in life insurance as firms continue to assume ownership of providers. Highlighting some salient risks: the lack of transparency of PE firms, inaccessibility of information on individual funds, “a spotty track record on owning diverse American businesses, and the possibility that they’d put insurer assets toward high-risk investments.

Center for Economic and Policy Research co-director Eileen Appelbaum calls for regulatory guardrails on private equity insurance investments: management fee limits on funds from retirement savings vehicles; an increase in reserve requirements; and a ban on self-dealing.

Senate Banking’s Brown has previously expressed concern over PE’s role in the industry, writing letters to top insurance leaders “to ensure policyholders are protected from the consequences of excessive risk-taking.”

PE and Healthcare.

In May, KKR-backed healthcare provider Envision filed for bankruptcy, marking one of their largest losses ever. Now, a second KKR-backed provider, GenesisCare, has bankruptcy on the horizon. Its credit ratings have been downgraded twice since October, and it’s buckling under the weight of debt acquired from its 2020 takeup of another service provider.

Related: A study of nearly 3,000 eyecare service providers finds that private equity investment leaves providers “volatile and vulnerable to economic contractions.”

PE and CRE.

Private equity wonders whether a bad time for the commercial real estate market might mean a good time for their own firms. Says one CRE lender:

“You’ll have significantly lower liquidity in debt markets, a huge wall of maturities coming due, a higher interest rate environment, meaning values decline, and you have a banking crisis at the same time, meaning that the amount of distress we expect to see in the system will be exponentially higher than what we’ve seen in the last decade. That is the big opportunity for the $400 billion of private equity sitting on the sidelines.”

Private Credit Boom.

Apollo Global Management believes the private credit industry may balloon to replace as much as $40tn of the debt markets. Some hedge funds are moving into the space too; Sona Asset Management plans to raise $500mn for a private credit push. But defaults have been inching upward after a period of lows, reports Bloomberg, signaling stress.

CRYPTO

Hong Kong Crypto.

First Digital, a Hong-Kong based qualified custodian and trust company, has unveiled First Digital USD (FDUSD), a stablecoin backed 1:1 by the U.S. dollar. The announcement comes in step with new guidelines effective June 1 regulating the safe custody of assets, separation of client assets, conflicts of interest and cybersecurity issued by the country’s Securities and Futures Commission. Related: Bloomberg examines how Hong Kong aspires to be a digital-asset hub.

HOUSING

Fighting for Rent Control.

Housing activists are arguing that landlords with federally backed loans should be required to provide more tenant protections. Says Tara Raghuveer, leader of the “Homes Guarantee” campaign at People’s Action:

“The corporate buyer of housing has created near-monopolistic elements in the current rental market where a small set of landlords are price setting—and we would argue price gouging—based on the kind of desperation that they know tenants are facing in the market, and also based on the fact that they bought up rather huge shares of the market… The market today is really only benefiting a select few profiteers who have structured the market to benefit them. A story of [millions] of tenant households across the country unable to pay the rent every month is not a story of market success; it’s a story of market failure.”

Zombie Mortgages.

Unbeknownst to some homeowners, their second mortgages are still kicking after seemingly going away. WSJ reports that some lenders “charged off” these mortgages and the mortgagees stopped receiving monthly statements. Now, investors who bought the loans for pennies on the dollar are coming after them with bills and threats of foreclosure, even despite timely payments on their primary mortgages.

CLIMATE and FINANCE

Republicans and ESG.

Politico reports House Republicans are gearing up in their crusade against ESG investment practices with a report, legislation and July hearings. In February, House Financial’s McHenry assembled a task group to rebuke what he calls a “threat to our capital markets posed by those on the far-left.” Rep. Huizenga signals that the operation is “going to be moving fairly quickly.”

On Tuesday, House Oversight will hold a hearing to examine what they call ESG’s “damaging effects” on American business.

A Harvard study finds that anti-ESG proposals have more than doubled in the past three years. There’s limited support across the board, on average. Who does support them, then? The likes of Steven J. Milloy, a climate change denier and “Burn More Coal” activist, and the American Conservative Values ETF, whose advisor has ties to a Koch-friendly policy shop, to name a few.