Americans for Financial Reform Education Fund and the American Antitrust Institute have released a new report reckoning with private equity’s expanding role in the home healthcare market. Private equity presence in this sector has contributed to the consolidation of hundreds of providers across the country into three dozen flagship parent brands, weakening incentives to deliver high-quality services at affordable prices. AFR-EF’s Oscar Valdés Viera:

“The presence of private equity in home healthcare is undoubtedly larger, but without meaningful disclosures, regulators and the public are left in the dark about the full impact of private equity ownership on competition and patient well-being.

Private equity’s own-to-plunder business model is incompatible with delivering health care in general, as the evidence from hospitals and other sectors shows. Concentration in home health care can only exacerbate these harms.”

FINANCIAL STABILITY: Failed Bank Execs – Recession Outlook – Commercial Real Estate – Investment Bank Consolidation – More on SVB

CONSUMER: Interchange, Again – Anti-CFPB Bill – Hello. Hello? – Enforcement Actions – Wall Street and China – Nevada’s EWA Bill

CAPITAL MARKETS: SEC and Security-Based Swaps – House Bills

PRIVATE MARKETS: PE and Warehouses

CRYPTO: SEC Crypto Enforcement – The Republican Bill – Addicted to Crypto – Crypto Capital Charges

CLIMATE AND FINANCE: Rebuttal of Waller – EU ESG Rules – Republican Hearing

Feedback? Reach us at afrnews@ourfinancialsecurity.org

FINANCIAL STABILITY

Failed Bank Execs.

Politico reports that Senate Banking will mark up legislation pertaining to executives at failed banks next week, according to Sen. Brown. Although he gave no indication which bill they would take up, the senator angles toward more than just clawback of incentive compensation; he wants industry bans, high fines and maybe more.

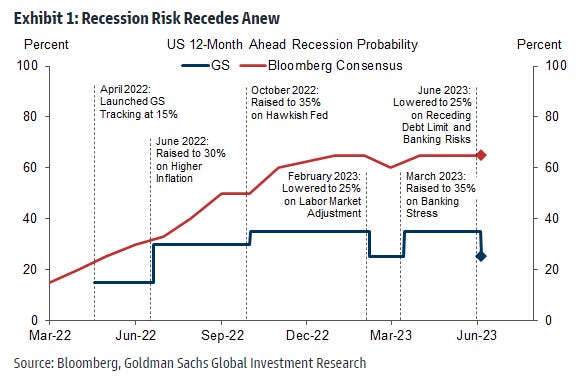

Recession Outlook.

In March, after SVB’s failure, Goldman Sachs pegged the risk of entering a recession in the ensuing 12 months at 35%. Now, it’s reeling the estimate back in to 25%, as WSJ’s Nick Timiraos presents. UBS expects a recession beginning later this year.

Commercial Real Estate.

A rash of banks prepare to sell off their commercial real estate loans at a loss, even if the borrowers are up-to-date on payments, reports FT.

Related: WSJ explores how interest-only loans, in which borrowers pay down the interest during the loan’s lifetime and the principal in lump-sum at the very end, contributed to a boom of commercial property ownership. The loans’ share of new commercial mortgage-backed securities issuance jumped from 51% in 2013 to 88% in 2021.

Investment Bank Consolidation.

In what FT calls the “slowest start to dealmaking in a decade” due to high interest and banking turmoil, large investment banking players are swallowing up smaller boutiques and brokers. The uptick in consolidation is expected to continue if mergers and acquisitions remain sluggish.

More on SVB.

The Fed’s report autopsying SVB found that the consulting firm McKinsey “failed to design an effective program” to manage the ailing bank’s problems, according to WashPo. The group had reportedly been hired to perform a targeted but “not a comprehensive risk assessment” and did not provide guidance on investment strategy.

CONSUMER

Interchange, Again

Sen. Durbin’s longtime push for lower interchange fees paid by retailers to banks and card networks got an extra push from Sens. Vance and Welch, a bipartisan duo. Rather than capping fees, as the Durbin Amendment did, this bill would increase competition by enabling more transactions to go outside the dominant Visa/MasterCard networks. " There’s a whiff of culture war here too; Vance called out Visa for “stick[ing] their nose in the social policy of this country.” The banking industry is united in opposition (ICBA and ABA) while retailers and consumer groups support such changes.

Anti-CFPB Bill.

House Financial considered a bill by Rep. Barr on Tuesday which seeks to provide banks between $10bn and $50bn more room for regulatory exemption, including the removal of oversight under the Consumer Financial Protection Bureau and some capital requirements. Accountable.US remarks on the bill’s similarity to the 2018’s deregulatory S.2155, also noting that the financial industry has provided over $6.8mn to Barr’s political career.

Limiting the CFPB’s supervision reach is part of the MAGA Majority’s plan to weaken the agency and let their industry donors do whatever they please no matter the cost to the financial system and consumers. Like Chairman Patrick McHenry, Rep. Barr has taken so much money from the financial industry he’s convinced himself that less regulation is the only answer when industry greed gets out of control and they make risky bets they can’t afford to lose.

Hello. Hello?

The CFPB zeroes in on the use of AI chatbots by financial institutions to field customer inquiries as stand-ins for flesh-and-blood service reps. It’s estimated that over a third of the U.S. interacted with a bank’s chatbot in 2022. They all boast varying levels of intelligence, some simply able to answer an FAQ and others algorithmically trained with actual conversation to more realistically assist consumers. The agency warns that the use of chatbots can result in noncompliance with consumer protection laws, diminish customer service and trust, and lead to harms against consumers. See Reddit user u/Whackatoe’s experience:

Enforcement Actions.

Since CFPB director Chopra’s confirmation, the number of enforcement actions undertaken by the agency has taken a dive. Last year, the Bureau took 20 enforcement actions, the second-lowest in a year on record after 10 in 2018 during the Trump era. Chopra’s predecessor, Cordray, filed a record high of 57 in 2015. But, writes American Banker, that’s likely just due to a difference in priorities. AB notes that Chopra has focused on bank supervision, citing his efforts to slash overdraft charges, for example, and repeat corporate offenders.

Wall Street and China.

The head of Goldman Sachs’ private equity dealings in Asia has decided to stop fundraising in the U.S. due to heightening geopolitical tensions between the U.S. and China, reports FT. Investors in North America have grown more reticent to put cash toward Chinese investments in recent months. In January, a Canadian teacher’s pension fund paused direct investments in Chinese assets.

Nevada’s EWA Bill.

This weekend, Nevada passed a bill concerning earned wage access, in which an intermediary entity can enable an employee to access their wages early, often for a fee. The bill, backed by industry trade groups and some EWA servicers, defines providers as non-lenders aside from merely requiring them to undergo an exam and audit process.

The National Consumer Law Center and Center for Responsible Lending opposed the legislation on the grounds of the non-lender designation, which would allow these companies to bypass Nevada’s statutes regulating credit. “The bill exempts fintech payday loans from even the minimal protections required of Nevada payday lenders without substituting meaningful protections,” writes the NCLC.

CAPITAL MARKETS

SEC and Security-Based Swaps.

A 3-2 vote by SEC commissioners finalized a set of rule changes designed to tackle fraud and strengthen compliance in the $8.5tn security-based swaps market. Under the updated rules, chief compliance officers would be shielded from influence by executives, employees and some market participants. Read the full release here.

House Bills

Warren is disagreeing with Waters on a clutch of Republican-led bills on exemptions from SEC rules that passed the House on the suspension calendar. AFR agrees with Warren.

PRIVATE MARKETS

PE and Warehouses.

The PE megafirm Blackstone has raked in a fortune buying into warehouse ownership. With 1,700 across Europe, they’re the largest owner of warehouses on the continent. These properties fit in a space five times as large as New York’s Central Park, using their partner M7’s digitized database.

CRYPTO

SEC Crypto Enforcement.

Just a day after suing Binance, the SEC filed suit against Coinbase, the largest crypto platform in the U.S., for failing to register as an exchange. Gensler says the crypto business model is “built on noncompliance with the U.S. securities laws.” The legal challenge comes on the same day that ten states accused the exchange of securities law violations in regard to its “staking rewards program.”

Politico explores the hefty political weight of Gensler’s action against the under-regulated digital assets sector. The timing comes in step with Republican efforts to undermine SEC jurisdiction over crypto, so “It is an interesting coincidence,” in the words of Rep. Hill. Says AFR’s Mark Hays, highlighting the need for tougher regulation: “We should be not assuming that crypto has some innovation payout right around the corner.”

Also: SEC court filings reveal companies associated with Binance sent transactions through Signature and Silvergate before their failures. Officials, including CEO Zhao, sent massive sums through the banks to accounts in various countries – Kazakhstan, Lithuania and the Seychelles, among others. Anti-money laundering experts posit that such large, rapid transfers should have raised alarm for bankers.

Bloomberg raises the issue of which of the thousands of cryptocurrencies could be designated securities. Altcoins – any token other than Bitcoin and Ether – accounted for half of Coinbase’s trading revenue.

The Committee on Capital Markets Regulation, whose members include the Bank Policy Institute’s president Baer and SIFMA CEO Bentsen, also weighed in with a few pages about the restrictiveness of SEC rules.

The Republican Bill.

House Agriculture Democrats have suggestions for the Republican-led draft bill from McHenry and Thompson, which would kneecap the SEC and empower the Commodity and Futures Trading Commission. Politico notes this may represent a general openness to the bill, where some House Financial Democrats have shut the idea down altogether.

CFTC chair Rostin Benhm supports the bill but wants further tweaks. Chief among his concerns: expanding the CFTC’s budget by separating it from the congressional appropriations process (at the same time that Republicans are trying to pull the Consumer Financial Protection Bureau into congressional appropriations). Benham also wants more power to focus on disclosure requirements, financial inclusivity and fraud prevention.

Addicted to Crypto.

FT dives into a subculture of people in the U.K. who say they’re battling an addiction with compulsive crypto trading. In the group therapy session the reporter attended, the patients described the trading apps as built to encourage compulsive investment and come down on quick profits, “echoing the rougher tactics of the early online betting industry.”

A 2019 study conducted by Rutgers found a strong correlation between those who gambled at least once a month and trading crypto.

Crypto Capital Charges.

EU officials will levy punitive capital charges against banks for holding risky crypto assets like Bitcoin and Ether, reports Politico. Stablecoins will be categorized by whether they’re backed by currency or assets, with the latter being subjected to heftier charges.

CLIMATE and FINANCE

Rebuttal of Waller

AFR’s Alex Martin authored a rebuttal to Fed governor Waller, who rejected the notion that central banks should supervise banks for financial stability risks on climate:

Waller’s remarks come as the Fed remains under fire for inadequate supervision and regulation around the collapse of Silicon Valley Bank. Its failure unleashed a banking crisis around interest rate risk, a well-understood problem. Should we feel confident about Waller’s glib dismissal of climate risks to financial stability? Absolutely not.

EU ESG Rules.

On Monday, Senate Banking’s Scott and House Oversight’s Comer sent letters to the Treasury and SEC in an effort to keep what they call an “EU-style climate regulatory regime” at bay. The two Republican lawmakers refer to a bundle of three ESG rules in the EU that “would be among the world’s most expansive corporate disclosure regulations related to supply chains,” reports Bloomberg, fearing that they’d catch on in the U.S. Read the letters here and here.

Republican Hearing.

House Oversight held a hearing Tuesday picking on ESG investment practices. Rep. Porter called the previous first of this two-parter “the stupidest hearing I’ve ever been to,” as Republicans ramp up their misguided campaign against ESG. Dems reminded Republicans that without mandatory ESG disclosure, the things that they’re asking for – money managers not to be able to make those decisions – wouldn’t be possible.

Private equity needs to get out and stay out of all healthcare related businesses.