After Silicon Valley Bank collapsed in March, the Federal Reserve’s Vice Chair for Supervision Michael Barr’s autopsy highlighted the need for strong bank capital rules. This week, Barr put some meat on the bones in a speech at a Bipartisan Policy Center event: “capital is fundamental to safety and soundness.” The proposals involve his holistic review and implementation of the Basel III endgame, the final step in their plans to shore up post-financial (2008!) crisis capital requirements. As AFR has argued, it’s time to ignore the self-serving arguments of the bank lobby and strengthen capital rules.

“The beauty of capital is that it doesn't care about the source of the loss. Whatever the vulnerability or the shock, capital is able to help absorb the resulting loss and, if sufficient, allow the bank to keep serving its critical role in the economy,” said Barr. “Higher levels of capital also provide incentives to a bank's managers and shareholders to prudently manage the bank's risk, since they bear more of the risk of the bank's activities.”

NYT calls the speech a “love letter to bank capital.” Notably, it addresses the problem that helped sink SVB: Banks above the aforementioned size would be required to account for unrealized losses and gains in “available-for-sale (AFS) securities” in capital calculations. Reuters sums up Barr’s areas of focus: Basel endgame, stress tests, liquidity, incentive compensation, interest rate risks and debt rules for “smaller big banks.”

Some of the changes include tweaking requirements “to better reflect credit, trading and operational risk.” NYT reports that banks wouldn’t be allowed to use internal models to approximate some types of credit risk or some more wily market risks. Institutions would also be required to create risk models for trading desks for certain assets. Importantly, banks with $100bn would be subject to more stringent oversight, a drop from $250bn.

Expect intense pushback from the bank lobby, with top Republicans angling to fight the reform efforts using industry talking points.

CONSUMER: Banking of America Junk Fees – The Case Against the CFPB

PRIVATE MARKETS: PE Medicine – Does Private Equity Improve Companies? – PE Homeowners

CRYPTO: Crypto Markets Bill – Crypto Regulations from the Treasury?

FINANCIAL STABILITY: Rates and Recession – The Fed Balance Sheet – The OCC’s BankReg Boomerang – Payments Anytime, Anywhere

HOUSING: Suspended Counterparty Program

CLIMATE AND FINANCE: Republicans’ “ESG Month”

POLITICS AND MONEY: Justice Clarence Thomas

Feedback? Reach us at afrnews@ourfinancialsecurity.org

CONSUMER

Bank of America Junk Fees

The CFPB won an enforcement order against Bank of America, ordering the bank to pay more than $100mn to customers for overcharging them with junk fees. In addition, the institution was hit with $150mn in penalties to both the bureau and the Office of the Comptroller of the Currency. In all, hundreds of thousands of consumers over several years suffered: a “double-dipping scheme” in which a $35 insufficient-funds fee could be charged against the same transaction multiple times; withholding rewards on credit cards; and misusing sensitive customer data to open unwanted accounts. Said Director Chopra: “The CFPB will be putting an end to these practices across the banking system.”

The Case Against the CFPB.

…is extremely weak, as evidenced by filings from John Eastman and the payday lending lobby. Eastman, the lawyer under investigation for his attempts to overturn the 2020 election, serves as the president of the Center for Constitutional Jurisprudence, which submitted a brief to the Supreme Court ahead of CFSA v. CFPB being heard in the fall. It largely echoes the CFSA’s and payday lending lobby’s argument, suggesting that the Bureau’s funding mechanism violates the Appropriations Clause of the Constitution. AFR issued a news release scrutinizing the briefs. Per AFR’s Kimberly Fountain, consumer financial justice field manager:

“The involvement of Eastman’s organization underscores the extent to which efforts to destroy the CFPB are rooted in extreme legal theories that have no basis in law or history. The Supreme Court should decisively reject this challenge to the CFPB funding mechanism.”

PRIVATE MARKETS

PE Medicine.

A new report from Americans for Financial Reform Education Fund entitled “Doctored by Wall Street” analyzes how private equity’s leveraged buyouts have resulted in degraded patient care, immense pressure on physicians and nurses, and financially distressed companies. The report recommends reducing incentives to game Medicare payment rules, stepping up enforcement of existing anti-fraud laws, empowering antitrust laws and enforcement, and shining a light on private equity ownership with more extensive disclosure requirements. Says AFR-EF’s Robert Seifert:

“We don’t need to wait for further tragedies caused by private equity ownership…There are traditional tools that federal agencies can use and loopholes Congress can close to end the siphoning of public healthcare resources for private profit, which erodes the quality of care and exacerbates patient suffering nationwide.”

And another new report from the American Antitrust Institute, UC Berkeley’s Petris Center and the Washington Center for Equitable growth scrutinizes private equity’s ever-expanding role in “monetizing medicine.” NYT provides an overview here. Private equity positions itself as an alluring alternative for practices that would otherwise be bought out by larger hospitals or insurance companies. But consolidation leads to higher costs for the consumer. The major bottom line: if PE controls over 30 percent of the market, the cost for services in gastro, dermatology and OBGYN “increased by double digits.”

Does Private Equity Improve Companies?

No. According to FT, Verdad Advisors analyzed a database of nearly 1,000 U.S. deals involving PE (where the pre- and post-acquisition data was even available). Companies swallowed up by buyout firms tend to do worse. Charts of revenue growth and gross profit dip, but one chart does soar: the debt-to-earnings ratio. Says Dan Rasmussen of Verdad:

"The industry mythology of savvy and efficient operators streamlining operations and directing strategy to increase growth just isn’t supported by data. Instead, there is a new paradigm to understand the PE model, and it’s very, very simple.

By and large, as an industry, PE firms take control of businesses to increase debt. As a result, or in tandem, the growth of the business and the rate of spending on capex slows. That’s a simple, structural change, not a grand shift in strategy or a change that really requires any expertise in management."

PE Homeowners.

Insider dives into the rapid proliferation of private equity into the rent-to-own housing market. Companies like Home Partners of America, which had BlackRock and KKR as majority stakeholders before Blackstone bought it out, sell the dream of a “clear path to homeownership” to families unable to buy right away. But residents say they’ve been “set up to fail” in squalor and with heavy financial burdens:

Home Partners tenants, in interviews and court documents, say they got stuck in barely livable dwellings, with leaking sewage, broken air conditioners, filthy carpets, or nonworking electrical outlets. They describe being blocked from seeing home-inspection reports and facing swift eviction filings for a single late payment. One tenant filed a lawsuit claiming she suffered injuries when the ceiling of her home collapsed.

In the Atlanta, Chicago, and Tampa markets, HPA has lodged eviction filings against tenants in more properties than they’ve sold. Residents reported feeling pressure from realtors to close quickly on lose-lose deals. And if they want to buy, annual increases in purchase price move the goalposts for people to whom mortgages are out of reach. For those that don’t buy, some “walk away with worse credit and less savings than when they started.”

CRYPTO

Crypto Markets Bill.

AFR and 20 other organizations sent a letter to House Financial and House Agriculture expressing opposition to a proposed bill championed by Reps. McHenry and Thompson intended to create a market regulatory structure for digital assets.

After 14 years, crypto still struggles to demonstrate viable use cases outside of speculative investment.8 While other tech has proven its usefulness many times over, crypto's big moment is always just over the horizon. Yet, a concentrated lobbying effort by the crypto industry has moved this Committee to advance a potentially radical proposal – and pass it through committee before August recess – that would, in the name of “crypto innovation,” weaken consumer and investor protections for both traditional and crypto investors.

Crypto Regulations from the Treasury?

In 2021, lawmakers resolved to reform tax reporting requirements to recoup the $550bn owed by the crypto industry. The Revolving Door Project questions why, years later, the Treasury Department under Yellen has yet to formalize these regulations. It would only take three revisions to the Internal Revenue code to “tackle a serious underreporting problem and bridge the tax gap.” New guidance from the agency was expected by the end of 2022, to take effect for transactions in 2023. But since the Office of Information and Regulatory Affairs approved the regulations in February, the Treasury hasn’t published any of the new rules.

FINANCIAL STABILITY

Rates and Recession.

On Wednesday morning, the Bureau of Labor Statistics released its Consumer Price Index report, marking a 0.2% rise in CPI. Headline inflation rose only 3% year-on-year, down from the 4% for the year through May; core inflation rose 4.8% percent year-on-year, lower than the 5.3% for the year through May. Although core inflation climbed more slowly, it remains above their 2% annual target. NYT sums up the important figures here: it’s a boon to consumers, but Fed officials are bound to proceed cautiously.

Chicago Fed President Goolsbee thinks it’s possible to tamp down inflation without sparking a recession if the FOMC continues its tack to hike at least twice more this year.

On Friday, the BLS released its jobs report for the month of June. Growth was somewhat lower than expected, with 209,000 jobs added versus an estimated 240,000. The Messenger provides an overview of what the report’s stats mean for the Fed’s plans: it “hits the ‘Goldilocks’ spot.” It provides the Fed more leeway to reconsider a likely hike next month, they write, a step toward the agency’s attempts to “cool off the labor market.” However, if the economy continues to churn out jobs at around this level, the transition may prove difficult, says economist Joseph Brusuelas. NYT has an overview of the important labor stats here.

The Fed Balance Sheet.

The Fed hopes to ease back on its qualitative tightening, under which Fed-held bonds are allowed to mature without replacement thereby “draining cash from the financial system.” In the process, reports WSJ, Powell remains particularly wary of a repeat of the years-ago repo crisis – in September 2019, securities entered the “repo pipes”' just as cash was heading out, leaving the entities who needed liquidity cashless and the system clogged. This time, everything’s flowing smoothly. The Fed’s loosing its bonds at about $1tn per year and there’s still $3.2tn in bank reserves left; analysts believe $2.5tn is enough to keep the banking sector running.

The OCC’s BankReg Boomerang.

The offices of the nation’s top financial regulators are short-staffed, marked by sharp declines over the past decade at the OCC and FDIC especially. That’s why the OCC’s taken to a recruitment drive they call the “boomerang” program, in which they encourage former examiners to rejoin the ranks. The FDIC does it too. In the FDIC’s report on Signature Bank’s failure, they noted that an average of 40% in their New York office for oversight of larger institutions have remained unfilled since 2020. Likewise, the Fed made mention of declining staff count in Barr’s report on SVB.

Payments Anytime, Anywhere.

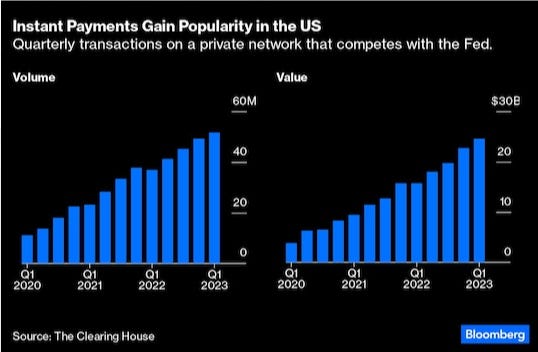

WashPost examines the FedNow instant payment service and the risks inherent in banking “going 24/7.” The popularity of a competing private service called RTP has risen over the past several years, and the introduction of FedNow may help the U.S. achieve parity with other nations where instant payments occur at much higher rates. While businesses and consumers alike are expected to benefit, WashPost recommends regulators be ready to adapt to a slew of new challenges. “Liquidity management…could take a back seat over time,” as financial institutions try to outdo their competitors in terms of offering the fastest, most flexible payments. And fraud might tick up, as payments over instant services are often nonrefundable.

HOUSING

Suspended Counterparty Program.

The Federal Housing Finance Agency has proposed a rule that would tweak the Suspended Counterparty Program (SCP). The SCP requires any entity regulated by the FHFA to submit a report to the Agency if they find that an individual or institution with which they do business “has been found to have committed certain forms of misconduct within the past three years.” The rule-change, open to comment now, would allow the FHFA-regulated entities to suspend business between themselves and “counterparties” which committed misconduct, as well as enable the Agency to suspend that business immediately without issuing an order if the misconduct “resulted in debarment, suspension, or limited denial of participation imposed by a federal agency.”

CLIMATE and FINANCE

Republicans’ “ESG Month.”

58 organizations including AFR sent a letter to House Financial opposing Republicans’ anti-ESG agenda, responding to a memo from the ESG Working Group on a series of proposed bills. Say’s AFR’s Natalia Renta:

“The majority’s policy agenda would insulate the management of public companies from investor input and accountability, and undermine regulations that would equip investors with more information to make better decisions…Investors — many of whom are workers saving for retirement — deserve to have a full and complete picture when investing their money and the ability to hold companies they’re invested in accountable.”

The Republican-led ESG Month, attacking investors’ and businesses’ abilities to incorporate environmental, social and governance considerations, is in full swing after a lead-in House Financial hearing on Wednesday under the guise of “Protecting Investor Interests.” (Take On Wall Street is live-tweeting it!) The hearing comes after the release of Huizenga’s ESG working group’s report last month. Five additional hearings on ESG will follow, topped off with votes on a package of 18 bills. According to Politico, the Committee is “prioritizing oversight of regulators and two proxy advisory firms,” rather than directing executives, keeping larger asset managers (like BlackRock and Vanguard) and big banks generally out of the crossfire. Many Democrats are rallying behind the market being able to make their own decisions on the matter. Says Rep. Casten: “We’ll continue to be the voice that’s defending the fact that the market should have a choice.”

While Politico says House Republicans are taking a less antagonistic approach, compared to Ron DeSantis who has called ESG efforts “ideological joyrides,” it is worth a reminder that a fair share of the anti-ESG shareholder proposals in 2023 came from the likes of right-wing climate change deniers and fossil fuel advocates, among others.

POLITICS and MONEY

Justice Clarence Thomas.

NYT examines SCOTUS Justice Clarence Thomas’ get-and-give relationship with members of the elite Horatio Alger Association of Distinguished Americans. Admittance to the organization afforded Thomas access to wealthy, mostly conservative elites. In return, “he has granted it unusual access to the Supreme Court.” Already under fire for his unreported ties to the billionaire Harlan Crow, the revelation of his connections to the Horatio Alger Association has raised more questions: