Less than two weeks ago, Solicitor General Elizabeth Prelogar defended the Consumer Financial Protection Bureau against the predatory payday lending lobby’s slapdash arguments before the Supreme Court, in a case that had sobering implications for financial stability. Happily, even the conservative justices were skeptical. And …

The CFPB marches on! This week, it has improved consumer protections and revealed how truly effective its work has been.

AFR was invited to an event at the White House yesterday, which included Becky Chong of Medford, Oregon, who described her experience with junk fees. Also, the head of the CFPB, Rohit Chopra , joined President Joe Biden to announce new, sweeping actions against junk fees – the hidden, unexplained charges companies tack on that inflate prices.

A new report from the CFPB’s Offices of Consumer Populations and Markets examined the impact of scaling back non-sufficient funds (NSF) fees, charges imposed by financial institutions when they decline to make a transaction. Two-thirds of banks with more than $10bn in assets have eliminated NSF fees, including 27 of the 30 banks that earned the most from these and overdraft fees. The changes are now saving consumers $2bn a year.

Not every bank is playing ball. The CFPB reports that their supervisory teams found consumers were hit with surprise overdraft fees and “double-dipping” on NSF fees at some banks. Offending banks had to refund $140 million to consumers. The agency also issued guidance to prohibit big banks from charging illegal junk fees to perform basic customer service, like checking account balances.

“Junk fees often unexpectedly affect the financial lives of American consumers in ways not known until after the fact,” said Elyse Hicks, consumer policy counsel at Americans for Financial Reform. “Hidden fees are not only cloaked in deception, they amplify existing inequities of wealth and access. The policies announced today will lead to greater transparency, which will shield consumers from harmful business practices by the financial services industry while forcing banks to compete on quality of service.”

FINANCIAL STABILITY: Capital Requirements – The “Weak Tail” – CFTC Collateral Requirements – Rates and Recession

CONSUMER: Credit Card Reward Bait-and-Switch – Junk Fees – Savings Bonds – CFPB Enforcement – USPS Rates – Other Consumer Stats

CAPITAL MARKETS: Ownership Reporting

PRIVATE MARKETS: Financial Engineering – Syndicated Loans – The New Kings of Wall Street – Private Equity, Public Responsibility – PE & Fertility – A Texas Two-Step in Prison Healthcare – ERISA – Other Private Markets News

CRYPTO: FTX and SBF – Crypto Interest

HOUSING: Mortgage ICE – Housing & Rates

CLIMATE AND FINANCE: California Climate

Feedback? Reach us at afrnews@ourfinancialsecurity.org

FINANCIAL STABILITY

Capital Requirements.

Fed Vice Chair Barr delivered a speech about how “Capital Supports Lending” at an American Bankers Association convention this week. He says the Basel III “endgame” requirements floated earlier this year are the “last major plank” in Dodd-Frank. Barr makes the case, with particular note that it would affect “only the largest banks”:

“When the initial reforms were put in place, bank regulators acknowledged that these changes were a partial measure and that there were further elements of the capital rule that needed adjusting: Less reliance on internal models for credit risk; operational risk should be captured in a standardized way; and capital requirements did not fully capture market risk…

The current framework could result in capital requirements increasing during stress, rather than requiring firms to hold sufficient capital in advance of the stress to be manage through a stress period. The framework also did not account for the large range of liquidity profiles across trading exposures.”

And on the impact to lending:

“The bulk of the rise in required capital anticipated in the proposed rule is attributed to trading and other activities besides lending—activities that have generated outsized losses at large banks and areas where our current rules have shortcomings. The estimated increase in capital required for lending activities on average—inclusive of both credit risk and operational risk requirements—is limited.”

The “Weak Tail”.

The International Monetary Fund warned that 5% of banks across the world are vulnerable to stress if rates remain high, per Reuters. Almost a third, including some of the largest, would be vulnerable if the global economy enters a state of “stagflation,” marked by low growth and high inflation. IMF department director Tobias Adrian says there’s a “weak tail of banks in many countries,” and the organization recommended that regulators undertake aggressive and “intrusive” supervision of banks and that lenders need to take “timely and conclusive” action.

Related: Bank of America earns less on its investments than its “closest rivals,” in part due to their hundreds of billions in “long-dated Treasuries and mortgage bonds at low rates that prevailed during the pandemic.” Now, the bank is loaded with “holdings that yield 2.4% in a 5% world.”

CFTC Collateral Requirements.

Sen. Warren opposes proposed CFTC rulemaking that would weaken Dodd-Frank regulations for seeded funds and money market funds. The senator wrote that: “These crises [the 2008 financial crisis and COVID-19 pandemic] revealed that the ‘lack of sufficient regulations’ in money market funds make them vulnerable to panic and massive runs that lead to ‘near-crippling turmoil in short-term funding markets.’”

Rates and Recession.

Small Business. The National Federation of Independent Business reports that small businesses feel “pessimistic about future business conditions,” as the NFIB Small Business Optimism Index clocked in at lower than the 49-year average for the 21st month in a row.

BB Bonds. The lowest-rated bonds, backed by subprime auto loans, have fallen to their lowest levels in a year – two percentage points lower than after the collapse of Silicon Valley Bank. Bloomberg reports that investors aren’t worried about consumers paying so much as they are macroeconomic conditions.

Wages. They’re growing more slowly, at a 3-month average of 4.3% YoY as of September.

Seniors. Hit the softest by rising interest rates: 65+ seniors, who accounted for 22% of spending last year.

CONSUMER

Credit Card Reward Bait-and-Switch.

The CFPB plans to crack down on credit card rewards programs that misrepresent to consumers how their points can be used. Director Chopra indicated the agency would examine how the Electronic Fund Transfer Act, a 1978 law that regulates electronic payments, applies to “private digital dollars.” The CFPB will solicit information from Big Tech payment companies and will consider supervising nonbank payment platforms. Said Chopra: “I fear that the US is lurching toward a consolidated market structure like the one that has emerged in China, that blurs the lines between payments and commerce and creates the incentives for excessive surveillance and even censorship.”

Junk Fees.

The Federal Trade Commission proposed a rule that would prohibit junk fees, expected to save consumers $10bn over the next decade and an estimated 50 million hours per year of “wasted time searching for the total price” just in the live-ticketing and short-term lodging spaces alone. The rule would mandate that businesses include all mandatory fees when reporting prices to consumers, and would allow the FTC to recoup refunds for harmed consumers or take monetary action against offending companies.

Savings Bonds.

Paper savings bonds resemble dollar bills but represent a bond, essentially a loan to the government, which generally double in value over the course of two decades. The holder might buy one for $50, then return years later to cash it out for $100. Except, lately, it’s gotten harder for people to cash out. Even though they’re “payable by any financial institution,” if the fine print is to be believed, many banks just aren’t interested. Some, like Capital One, refuse to accept savings bonds at all; others, like JPMorgan and Wells Fargo, have limits on the value of bonds (including interest) that can be redeemed.

CFPB Enforcement.

The CFPB filed a lawsuit against Freedom Mortgage Corporation, alleging that it “submitted legally-required mortgage loan data that was riddled with errors” in violation of the Home Mortgage Disclosure Act and a 2019 consent order.

USPS Rates.

The Postal Service is planning a 2% increase in mail rates in an effort to offset “accelerated declines in mail usage,” Government Executive reports. Says AFR’s Annie Norman:

“DeJoy's obsession with raising prices is one more example of how he's just not the right fit to lead USPS. Instead of hiking prices on existing services and consolidating physical locations, he should be focused on bringing in new revenue.”

Other Consumer Stats.

“Everything about buying and owning a car has gotten more expensive,” NYT reports. In the first five years of ownership, the cost per car hit $12,182 this year – that’s 16% of the median household’s income – up from $10,728 last year.

CAPITAL MARKETS

Ownership Reporting.

The SEC adopted changes to a rule related to 13D disclosures, reports meant to “alert the market about a potential change in corporate control.” Originally, if an investor took over more than 5% in a company, they would have to submit a disclosure within 10 days. Under the new rule, that time comes down to five business days. Last year, the Managed Funds Association suggested the rule would “hobble the free flow of information through the market.” Gensler defends the rule, pointing to this “era of 24-hour media cycles and high-frequency trading” making the 10-day deadline feel “antiquated.”

AFR signals that the changes represent a significant move toward creating a more equitable investment landscape that will increase transparency for investors, though AFR’s Natalia Renta notes that “we hoped the SEC would finalize a rule that maintained its proposed five calendar day filing window instead of watering it down to five business days.” Says AFR’s Andrew Park:

“These changes modernize rules written decades ago so that investors will now be better informed of large stakes taken by other investors that could have a significant impact on them. The SEC is also addressing a long-running gap between how stocks and derivatives with the same economic exposure are treated so that activist investors can no longer evade reporting or scrutiny simply by their choice of financial instrument.”

The decision came after a campaign by industry lobbyists, who suggested that labor opposed the proposal. Numerous groups representing labor unions across the country wrote in a letter to the SEC that they did support the rule.

PRIVATE MARKETS

Financial Engineering.

The Institutional Limited Partners Association (ILPA), a group representing private equity investors, will more heavily scrutinize private equity firms’ “use of debt and complex financial engineering to generate returns from the companies they own,” FT reports. Investors demand disclosure about the associated costs and risks, as more firms turn to using margin loans and natural asset value (NAV) financing to “boost returns and fund distributions to investors.”

Syndicated Loans.

SEC Commissioner Crenshaw flags that the $1.4trn leveraged loan market is “not subject to meaningful regulation and investors are being put at risk.” She expressed concern that “systemic financial issues are lurking in the market, and that if these instruments are not monitored more closely, the risk to the financial system itself will continue to grow.” Crenshaw calls for close examination of the market by regulators ahead of a historic amount of such loans coming due over the next several years.

The New Kings of Wall Street.

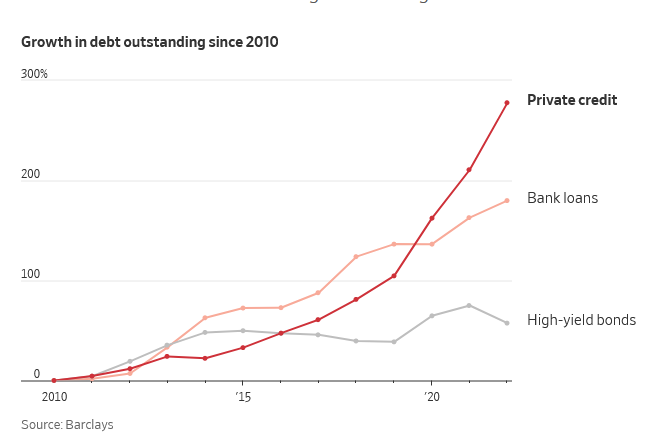

Private funds – private equity and hedge funds among them – have dethroned banks as what WSJ calls the “kings of Wall Street.” Traditional banks have pulled back on lending while interest rates remain high, and private credit dealers have moved in to fill the void. Private equity firms use the revenue from these costly loans to finance leveraged buyouts, saddling their purchased companies with tons of expensive debt. Some concerns highlighted here: the overconcentration of so much economic activity in opaque and under-regulated asset managers, a higher likelihood of corporate defaults thanks to high rates, and the diminishment in the average quality of these managers’ investments (keeping in mind workers’ retirement funds and pensions are tied up in them).

“Bank of America, Barclays and other large banks that got stuck holding billions of dollars of leveraged loans in 2022 are sitting on the sidelines this year even as the buyout market revives,” FT reports. “Several were burnt last year when they struggled to find investors willing to purchase debt linked to Elon Musk’s purchase of Twitter and other deals.”

Private Equity, Public Responsibility.

An article in FT asks, “Can private equity meet public responsibilities?” and advises more transparency and accountability from the sector to be able to put their mass sums of capital toward “financing a sustainable economy.” Some have called private equity a “transformation engine,” given its longer-term strategies and use of growth capital. Investment in private ESG funds has only increased every year since 2012. But the market’s opacity can make it difficult to judge the veracity of any of their purported commitments to sustainability, and it has a track record marred by “buy, strip and flip” business model and its more dubious investments (in fossil fuels, for example).

PE & Fertility.

“Private-equity firms own some of the largest fertility-services providers in the U.S. after several years of buying practices and expanding them through acquisitions, fueled by surging demand as health plans increasingly cover fertility treatments and more people start families later in life,” WSJ reports. Now, PE-backed clinics plan to put money toward solving a staffing crisis, as the demand for specialists has outstripped the supply.

A Texas Two-Step in Prison Healthcare.

Last year, Corizon Health – a prominent, private investor-backed prison healthcare provider that, as of July 2023, faced 475 active lawsuits, mostly related to malpractice – undertook a “Texas Two-Step,” a controversial practice whereby the company split into two parts, placing all their assets in one arm, called YesCare, and all their debts in another. Then, they filed bankruptcy on the latter, a company called Tehum, so as to protect assets which included more than $1bn in public sector contracts. In a legal filing, Tehum’s director said the maneuver could “force plaintiffs into accepting lower settlements.” A complaint filed in federal court “casts doubt over the neutrality of the judge” who oversaw the proceedings, as he was involved in a relationship with a bankruptcy attorney that represented YesCare.

ERISA.

The Supreme Court opted not to hear a case related to whether a dispute related to the Employee Retirement Income Security Act of 1974 (ERISA) should be decided in court or by arbitration, letting stand a ruling delivered by a federal court that stated the arbitration agreement in question was unenforceable because it “disallows a litigant from seeking plan-wide remedies.” The case arose when Envision Management Holding performed an employee-owned stock sale that defendants alleged violated ERISA by harming them financially. The federal court’s ruling overturned a previous ruling that said an employer could enforce arbitration in such a complaint.

Other Private Markets News.

Over two years, PE firm Warburg Pincus raised $17.3bn for the largest fund in its history. “The fund will focus on Warburg’s core business of corporate buyouts and equity stakes in companies, aiming to make between 75 and 90 investments averaging about $175mn apiece,” per FT.

JPMorgan has a new private markets fund meant to attract individual investors, rather than the institutional investors such funds often draw (though it is still open to the latter). It oversees $30bn in PE assets, with a minimum $25,000 commitment requirement. Already, they’ve collected $100mn in commitments.

The value of private equity exits has hit one of its lowest points in a decade in Q3 2023, with the exception of the pandemic era’s Q2 2022.

CRYPTO

FTX and SBF.

Some reporting about the collapsed crypto exchange FTX and its founder, Sam Bankman-Fried, currently on trial for wire fraud, money laundering, and misrepresentations to investors, among others:

Customers reportedly had $16bn tied up in FTX. Its execs spent nearly $8bn of it elsewhere. The breakdown: $5bn went to venture-capital investments in tech companies; $2.2bn was paid out to insiders, some of whom used it to finance personal investments; about $243mn went to real estate in the crypto-friendly Bahamas; and $80mn went to politicians and charities.

Bankman-Fried “stole customer funds from the beginning,” according to co-founder Gary Wang. That’s counter to the defense’s claim that it was a startup where “some things were overlooked.” And SBF directed Alameda Research, the company that was allowed limitless access to customer deposits, to commit fraud, according to Alameda’s CEO, who says she would send balance sheets that made the company look “less risky.”

Crypto Interest.

Why do people invest in crypto? According to Fed data, the majority (67%) of sampled respondents view it plainly as an investment. In second place, 20.7% said they’re interested in “new technologies.” Brookings Institution’s Aaron Klein raises that, counter to claims by crypto industry insiders, it isn’t about “actual use cases…or distrust of banks” Worth noting: the sample consisted of only 382 crypto owners.

HOUSING

Mortgage ICE.

Earlier this year, Intercontinental Exchange (ICE), parent company of the New York Stock Exchange, purchased the mortgage software provider Black Knight, giving rise to fears that the company would have excess control over a market that “touches vast swaths of the U.S. population.” Rep. Waters previously said the company would become “a housing finance conglomerate that would dwarf all other players in the industry.” Now, the company is promoting an all-digital alternative to closing paper mortgages, which currently takes about 30 to 45 days.

Housing & Rates.

Three housing industry groups – the National Association of Realtors, Mortgage Bankers Association and National Association of Homebuilders – sent a letter to Fed Chair Powell requesting no more rate hikes. The high-rate environment has “exacerbated housing affordability and created additional disruptions for a real estate market that is already straining to adjust to a dramatic pullback in both mortgage origination and home sale volume,” they said.

CLIMATE and FINANCE

California Climate.

Cali Gov. Newsom signed into law a set of “first-in-the-nation corporate climate disclosure bills,” detailed more here. Starting in 2026, large corporations will have to start thorough detailed disclosures related to their carbon footprints and climate-related financial risks. Importantly, the pair of bills incorporate Scope 3 disclosure requirements, mandating disclosure of emissions up the supply chain. AFR has previously called for the implementation of Scope 3 requirements at the federal level, too.

Great news on the junk fees finally and Californias new climate laws. Thank you for this work.